It’s hard to find an article or presentation on the changes underway in the power sector that don’t at least reference Peer-to-Peer energy trading (P2P). And this isn’t just talk, there are a raft of emerging peer-to-peer energy solutions in Australia.

Here are a few examples of the peer-to-peer projects I’ve found in Australia, and I’m sure there’s some I’ve missed. If we were to look more widely we would probably find hundreds (no hyperbole) of similar trials and product launches around the world.

When you read articles or presentations that talk about an energy future with P2P at the centre, there is always a reference to blockchain. The two ideas aren’t inextricably linked, and P2P solutions are being created that aren’t based on blockchain, but for some commentators they have almost become synonymous.

I find P2P fascinating. There is an undeniable consumer interest in taking control and being self-sufficient. The big trend we are seeing in the power sector is a shift from centralised resources to distributed resources, and not just distributed in a physical sense, but distributed in an ownership sense. Instead of effecively being a ‘renter’ of energy resources, and being a disempowered price taker, solar and batteries allow a consumer to become an ‘owner’ of energy resources, and P2P provides the promise of being the price maker!

It’s definitely something we should be paying attention to. But I also feel that the level of public discussion on P2P has been superficial. Here are some classic ways that peer-to-peer is promoted from a few articles I’ve just Googled. Inevitably there is no real detail beyond these kinds of high-level assertions.

“A groundbreaking rooftop solar trading platform that cuts out the energy market middleman and allows consumers to buy and sell renewable power at prices negotiated among themselves.”

“The [P2P] system allows consumers to take advantage of other users who produce more energy than they need. Those consumers can sell their excess power for profit. The main advantages are: - No middle man – people make deals on their own terms - Everyone saves money - Transparent dealings directly with other consumers”

“Peer-to-peer energy trading presents an opportunity to unlock enormous value for consumers. It disintermediates the energy supply model, putting consumers in direct contact with other consumer”

“The aim is that consumers who purchase their energy via the [the platform] have the added benefit of getting their energy for cheaper than they would from the grid (and it’s green!!) and local producers (prosumers) earn more than they would selling their energy back to the grid.”

“The [P2P platform] has been designed to independently facilitate trading energy between peers using a combination of blockchain technology, IoT and artificial intelligence.”

Does P2P really cut out the middle-man? Does everyone really save money? Is it really transparent? Are consumers really in direct contact with other consumers? And, does P2P depend on blockchain (or IoT? AI?)

I’m not an expert on P2P. I don’t have any direct involvement in any of these projects or an insiders perspective, so this series two articles is just my attempt to reason about and discuss what really might be going on with P2P, and to hopefully get some feedback and ideas from other people to try and clear up any misunderstandings I have as I try answer those questions.

Peer-to-peer energy trading (P2P) is often characterised as being an example of the ‘sharing economy’, best exemplified by Uber and Airbnb. The idea of the sharing economy is that you can make money from selling access to underused assets: your car, your house, even designer clothes and powertools, or, in the case of P2P your solar panels and batteries.

I don’t think the analogy to the sharing economy is exactly right. Consider that I have a car and a house, not shared on platforms like Uber and Airbnb, and, unsurprisingly, my neighbours don’t use my car or my house (I hope!)

I also have solar panels on my roof that produce excess energy, also not shared via any P2P trading platforms, but I am a ‘prosumer’ because my neighbours do get to use the energy my solar system exports to the local electricity grid even though I’m not ‘trading’ with them.

It is electrical infrastructure and physics that enables energy sharing, not a coordination/trading platform layered over the top.

How much energy my solar system exports to the grid is entirely unrelated to the price I complete a trade, or whether I even find a buyer, on some hypothetical P2P platform. Similarly, who actually gets the energy my solar system exports to the grid is entirely unrelated to the buyer I might trade with. Nothing that happens on a P2P platform can directly influence how energy is shared, because P2P isn’t the physical enabler of energy sharing and has no interaction with electricity flows.

To the extent P2P can have any influence on when and where energy is exported by one party and imported by another, it is only indirectly via behavioural economics (people changing behaviour based on incentives): “Perhaps if the price of energy is high right now, I will use less energy, so more power from my solar system is exported”; “If I can sell my excess energy for more money, I will install a bigger PV system”. With the addition of batteries consumers can potentially start to get some direct control of when they might export, which we’ll reason about how batteries fit in more when we try and work out the future of P2P.

P2P is really a direct competitor to the current way we provide an incentive for prosumers to export energy to the grid: the feed in tariff (FIT). It’s just an alternative model.

So if P2P is all about economics, we need to look more closely at the current economics of electricity markets in Australia, but we’ll need to do a detour first and talk about electricity retailers.

We generally just see the bills that retailers issue to us and so think of them as just doing billing (and “profiteering”; no one seems to like Retailers).

The traditional view of the electricity value chain was Generators → Transmission & Distribution → Retailers → Consumers. Then as we started to see more and more deployment of ‘Distributed Energy Resources’ we added a few backward/looping arrows to reflect ‘prosumers’ in the value chain.

But, unlike all of the other participants in the supply chain, Electricity Retailers aren’t involved in the physical generation or supply of electricity. They are selling a product they never physically touch. Because of this, blockchain aficionados might describe Electricity Retailers as ‘rent-seeking intermediaries’ that are ripe to be disrupted. We’ll figure out where blockchain fits in later

So, if they aren’t involved in the physical supply of electricity what are they doing?

They are buying and reselling energy using existing ‘peer-to-peer’, if you like, physical and financial energy trading markets (e.g. NEM,WEM and ASX Energy, STTM, or making direct ‘bilateral trades’ with each other) but the ‘peers’ in these existing trading markets are around 150 generators and retailers and some liquidity providers/market makers, and not, for the most part, end consumers, as envisioned by P2P.

And the Electricity Retailers aren’t just buying and reselling energy, they are also buying and reselling network services (transmission and distribution) and paying for metering, market operations, and environmental certificates (that fund renewable energy and energy efficiency incentive schemes). Retail electricity products are a bundle of these underlying services, of which energy is just one component of the bundle. Retailers turn these bundles into products they sell to consumers (including, for example, products that include a ‘feed-in-tariff’ as a component). One important characteristic these products generally have is simple, fixed pricing.

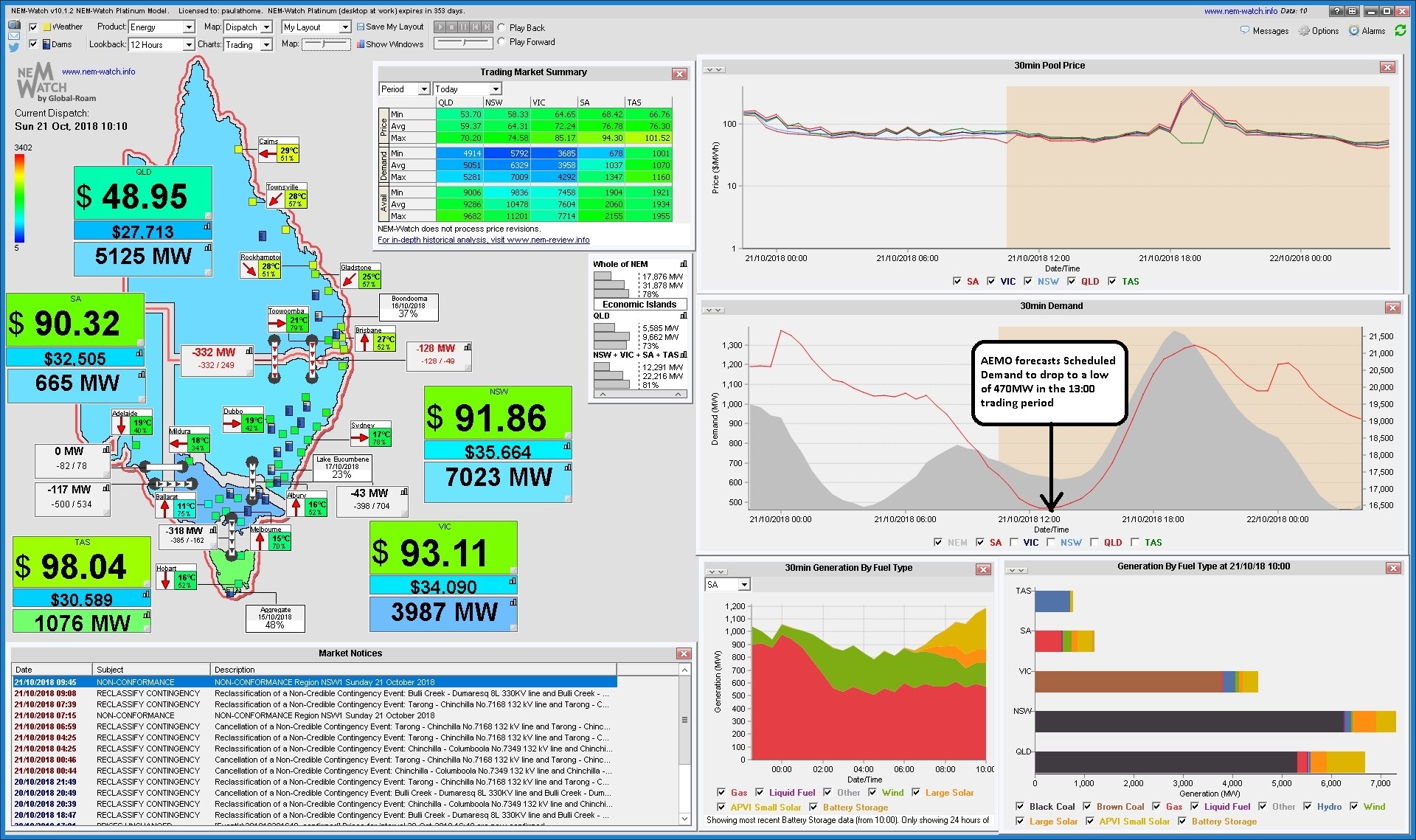

The underlying services Electricity Retailers are buying and bundling together are complex and exist within the context of multiple fairly dynamic markets: wholesale energy prices on the NEM can swing thousands of dollars per megawatt-hour in a 30-minute period (dollars per kilowatt-hour if you are thinking about it in terms of your household bill where you are paying cents per kilowatt-hour); in the WEM there is a capacity market, as well as short-term energy market and a balancing market (but with lower caps than the NEM); network tariffs can be very complex with different structures and charges in different geographic areas; environmental certificate prices are also volatile with price risk to be managed; even metering is often a competitive service with different providers offering different terms and prices; there are ‘ancillary services’ markets; demand response markets; financial markets with ‘options’ and ‘derivatives’ to hedge against volatile energy prices (swaps and caps and more); third-party insurance products to protect against extreme weather events that might drive up wholesale energy prices; and so on. It can get pretty complex.

They have one last extremely important job. They meet the prudential requirements of the market. They take on all the credit risk on behalf of the market. If the customer pays their bill late (or never pays their bill at all), the retailer still has to pay the generators and networks and everyone else who is providing the underlying services that the retailer is ‘on selling’.

The working capital requirements for retailers are onerous, and the market operator is constantly monitoring the market positions of retailers, particularly in volatile market conditions, and can require retailers to demonstrate they have sufficient credit support at short notice. On the NEM, retailer failure is not uncommon and the regulator appoints a ‘retailer of last resort’ to take on customers when this happens.

So, on the one side they Electricity Retailers give consumers simple ‘retail’ products with fixed pricing; on the other side they manage risk and guarantee payment to the ‘wholesale’ market participants who are actually delivering services to the consumer.

So with that context, let’s return to the economics of peer-to-peer trading.

We’ll have a go at working out the future of P2P later, but today it seems to only be discussed and promoted in the context of enabling residential customers to sell their excess solar for more than the feed-in-tariff offered by their retailer (or in some cases their embedded network provider).

We’ll have a go at working out the future of P2P later, but today it seems to only be discussed and promoted in the context of enabling residential customers to sell their excess solar for more than the feed-in-tariff offered by their retailer (or in some cases their embedded network provider).

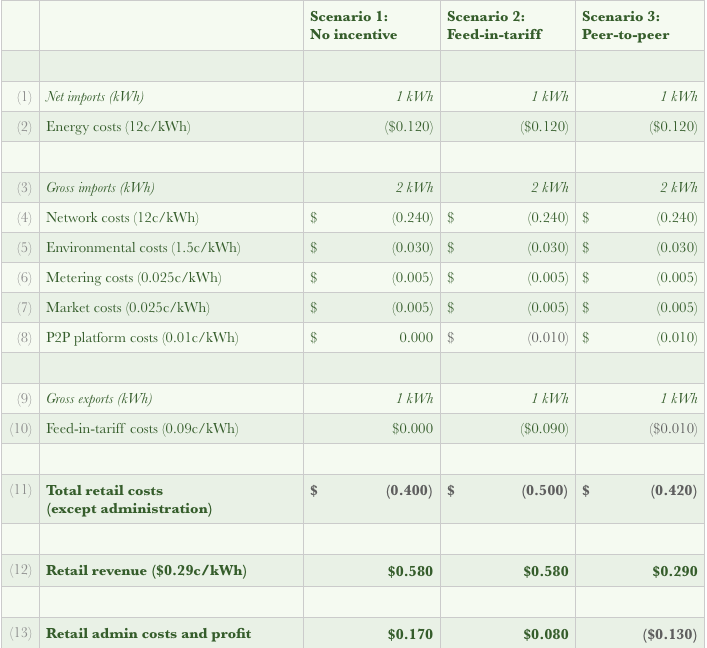

For the purposes of discussion, let’s assume the ‘average’ residential bill cost-stack looks something like this, for a total average cost of 29c/kWh:

When this cost stack is translated to a retail charge for a consumer, there is probably going to be a daily supply charge, but for now we’ll just thinking about the economics based on passing through costs on a volume basis.

With those cost assumptions let’s consider a few scenarios for Sarah Solar who has solar panels on her home, and Nora Neighbour, who doesn’t. And let’s consider a hypothetical 30-minute period on a sunny day somewhere in suburban Australia where Sarah is exporting and Nora is importing.

Scenario 1: In our first scenario there is no economic incentive for Sarah to export. Sarah is energy self-sufficient so pays nothing for her two units of consumption. Nora pays $0.58c to her retailer for her two units of consumption. The combined net cost for our two neighbours is $0.58.

Scenario 2: In our second scenario we have a feed-in-tariff of 9c. Sarah still pays nothing for her two units of consumption, but now gets paid 9c for the unit she exports to the grid. Nora continues to pay $0.58c to her retailer for her two units. The combined net cost for our two neighbours is down to $0.49.

Scenario 3: In our third scenario Sarah and Nora complete a trade on a Peer-to-Peer trading platform and settle on a price of $0.15/kWh. Sarah still pays nothing for her two units of consumption, but now gets paid $0.15 for the unit she exports to the grid. Nora only pays $0.29c to her retailer for one unit of energy, and pays $0.15 to Sarah for her second unit. The combined net cost for our two neighbours is down to $0.29 (just the 29c Nora is paying to her retailer for the unit that Sarah didn’t supply).

Happy days! Compared to our first scenario with no solar export incentive, P2P trading has saved 29c (which could be hundreds of dollars over a year for our newly empowered consumers), and is better than our second scenario with a feed-in-tariff by 20c. So the question is where has that 20c come from? Peer-to-peer trading didn’t create any new energy, so did it create new economic value in some other way?

By my way of thinking, the 20c consumer saving must come at the expense of an existing electricity market participant, so if this is going to be economically efficient we need to discover if and where it reduces the upstream costs in some way.

We also need to consider that there is one new increased cost to account for. Whether or not they are based on blockchain, P2P trading platforms have a cost to develop and operate, and the providers of these platforms have a profit motive. So when we revisit our retail bill-stack we will add in a $0.01/kWh administration cost for our P2P platform. Again, in practice this might not be passed on to the consumer volume based charge It might be a ‘subscription fee’ the consumer pays of say $30 per month, or a cost the retailer absorbs as part of their administration costs.

So to track down that 20c, let’s look at the bill stack again from the Electricity Retailers perspective.

So in all three scenarios we have reduced the energy costs for the retailer on the basis of the energy that Sarah Solar is exporting (line 9), but all other costs have been retained on the basis they relate to the gross energy Sarah and Nora are importing from the grid (lines 3 to 8).

The total revenue the Retailers receives is based on the gross imports for Scenario 1 and Scenario 2, but is only based on the net imports for Scenario 3 (line 12). One way of thinking about the difference between the three scenarios is that with P2P, the Retailer only receives revenue for the net energy imported, because the gross energy is offset by the trades the two consumers make.

The net position (line 13) is that there is no margin left for retailer administration costs (or any profit) in the P2P scenario, and we have effectively just shifted value from the retailer to the consumer, and no new value has been created.

If we think back to the full set of underlying wholesale services the retailer is bundling into a product, the energy Sarah exports offsets only one of these costs for the retailer - energy - but none of the others. One obvious solution to this, that I think some P2P platforms are adopting, is for P2P to only apply to the energy component of the bill stack (although its generally not in the headline marketing). Effectively the other cost components can passed through to the consumer. This works but dramatically reduces the value proposition to the consumer, which is the big spread they perceive between the rate they are buying electricity and the rate they are selling their exported energy.

If P2p becomes ‘energy only’, the opportunity shrinks from say, up to 20c (29c electricity rate minus 9c FIT) to up to 2c (12c energy-only rate minus 9c FIT plus 1c P2P platform charge). But then P2P is just not that compelling. If you then add in the time (and hassle?) for the consumer to actively engage with the P2P platform then it’s hard to see this value proposition as being compelling for all but the most engaged and tech-forward energy consumers (most residential consumers don’t even look at their bill), when compared to what they might get from a feed-in-tariff. And if the consumer is in a market with competitive retailing and there is value being from solar exporting being left on the table, then competition should drive retailers to offer a higher FIT, sharing some of that value with the consumer, to be competitive.

But even for energy-only P2P there is some additional complexity and risk to consider. Our assumption of an average retail cost price of 12c per kWh for energy might not be correct at the actual times when the P2P consumers are actually trading.

The actual wholesale energy costs for the interval in question could be much lower than 12c, as low as negative $1/kWh on the NEM (i.e. you have to pay a $1 to export energy to the grid) up to positive $14.5/kWh. Note the price caps are much lower on the WEM.

It’s hard to examine the interplay of P2P with wholesale energy in the simplistic model we’ve been considering above as Electricity Retailers will generally be hedged against super high prices (i.e. establishing there own ‘cap’ of say $200/Mwh so they aren’t exposed to the market price cap of $14,500/MWh on the NEM). If we were to try and do this properly we’d have to start taking into account the fact the retailers will have bilateral contract positions with some generators that fix the price they are paying for energy irrespective of movements in the wholesale market, they will have financial contracts in place to hedge against high prices (caps), and they may be able to draw upon other resources like demand response to manage price risk, and so on.

And of course we do have what some people describe as an oligopoly in Australia where our biggest retailers own lots of power stations (or our biggest generators are also retailers, depending on your perspective), which means that high wholesale energy prices aren’t just a retail cost risk, they are a wholesale revenue opportunity. And there is further complexity that many market participants are still Government owned, and the Government has been known to put their fingers on the scale. But for the purposes of this discussion, let’s imagine we live in a pure market world (and remember that many smaller retailers do in fact live in this world).

While high wholesale energy prices can be problematic, let’s focus on low and even negative wholesale energy prices. The times of day that Sarah Solar is able to export probably coincide with times when other roof-top solar systems are exporting and when we are getting maximum output from the ‘solar-farm’ power stations that are connected to the grid. That is the times of day when energy on the grid is more likely to be in surplus and energy prices are more likely to be low.

It happens that large-scale renewable energy generators (solar and wind power stations) are happy to ‘bid into the market’ at negative prices because they benefit from ‘LGC’ revenue (the incentive we provide to help Australia meet its renewable energy target, which energy consumers pay for via environmental certificate schemes). So even if the wholesale market is saying their energy isn’t required, and is offering negative prices, it is profitable for large-scale renewable energy generators to keep producing. In these low or negative wholesale price environments conventional thermal generation will still be producing some energy because they can’t quickly ramp up and down, and because they are required to provide other services to the grid besides just energy.

We are now regularly seeing negative wholesale energy prices in the middle of the day on clear sunny days in South-East Queensland and Western Australia, and this is a trend that will only continue as the penetration of solar inevitably increases.

So let’s imagine Sarah and Nora live somewhere with these market conditions, and for this hypothetical 30-minute interval we’ve been considering, let’s imagine the wholesale energy price was negative $150/MWh (-15c/kWh). So now in our P2P scenario the Retailer has to pay 15c for the unit Sarah exported (it’s a liability the Retailer is responsible for in the wholesale market, even though Sarah is trading with Nora); is continuing to be financially responsible for all of the services Sarah and Nora are using, like the use of the distribution network and having capacity available for those intervals when Sarah can’t supply energy to Nora; but is not receiving any revenue for the energy Sarah exports or that Nora imports.

For our Scenario 3 above, it brings the Electricity Retailers net position down from negative 13c to negative 28c. Again, this might seem like a small number but this is for just one 30-minute interval and just one trade between just two consumers. If we are hoping for large-scale adoption of P2P, these numbers will get big very quickly.

One possible response to our hypothetical retailer losing money might be, “Good! Stuff the retailers.” But that is not economically sustainable; markets and regulations would respond, and rate structures would change such that either Sarah and Nora pay their fair share, or other consumers end up paying it for them (e.g. increased ‘daily supply’ charges). That is, we end up just socialising the cost of that ‘saving’ across other energy consumers.

Another response might be “Hey, what about the networks?!”.

We haven’t shown any change in network costs in our scenario, which does reflect the facts of the current situation given current network tariff structures and market rules. The fact that Nora used some locally generated energy from Sarah doesn’t change the network costs the Electricity Retailer will actually incur for either of them.

One of the big arguments for encouraging more local generation with P2P trading is that it reduces the costs and losses associated with transmitting energy over long distances from large centralised power stations. So following this argument, we should reform network tariffs to incentivise local generation, and maybe that would make P2P more compelling?

One way that has been proposed in the past to encourage local generation is the idea of ‘local generation network credits (LGNCs)’. The idea was that networks would pay ‘prosumers’ a credit that reflected the estimated long-term benefits that they provided in terms of deferring or down-sizing network investment, or reducing operating costs.

The networks made the case in return that local generation doesn’t reduce their costs. They said that LGNCs would effectively just increase costs to other consumers, while offering little or no deferral of network investment. Networks have a regulated return on capital guaranteed, so if their costs go up, effectively these costs are just shifted to the consumers who aren’t benefiting from LGNCs; consumers who may be less able to bare them than the kinds of consumers who are installing large solar systems and who might embrace P2P.

One big difference between this line of thinking and the conventional value proposition for P2P, is that there is a clear statement about how new economic value might be being created (LGNCs: local generation reduces network costs), and not just value be being shifting around (P2P: just get paid more for exporting). So whether or not you accept the networks arguments about local generation, and many don’t, if you were to reform network tariffs in this way, and that provided a real economic benefit from having more local generation that was shared with consumers, then do you really need peer-to-peer trading?

It begs the question: what are we trying to achieve with P2P, and are their other mechanisms we should also be considering as alternatives or complements to P2P.

We’ll try and answer this question in the second article. We’ll also look at where blockchain fits in; where batteries fit in; and, we’ll speculate about the possible future for P2P beyond just being a more rewarding feed-in-tariff (spoiler: despite the above probably sounding negative, I do think there’s a future for P2P). Did you read this far? I would love some feedback: fabian@dlgb.net 🙋♂️.